Foreign companies seeking to setup manufacturing operations in Asia are increasingly by-passing China for other countries, with Thailand, India, and Malaysia the most popular alternatives or even outright preferred locations , according to a new report by management consultancy firm Nexdigm.

For years, China has been the primary center of foreign direct investment in South Asia. However, the country’s status as the top manufacturing destination has been called into question for several reasons in recent times.

Following China’s supply chain disruptions during the Covid-19 pandemic, and the mounting geopolitical pressures the country is facing, companies and investors worldwide are now revaluating their decisions on where to offshore their manufacturing operations. South Asia’s top destinations for offshore manufacturing operations

One reason is the increasing labour costs in China, which is gradually making other countries in the region more attractive to foreign investors. Moreover, China’s environmental regulations and labour laws are making it more complex for manufacturers to operate and comply.

There are also concerns about the country’s intellectual property laws and trade practices, which have been the subject of international criticism. Further, political tensions between China and other countries in the region, such as Japan and India, have led some businesses to look for alternative manufacturing locations.

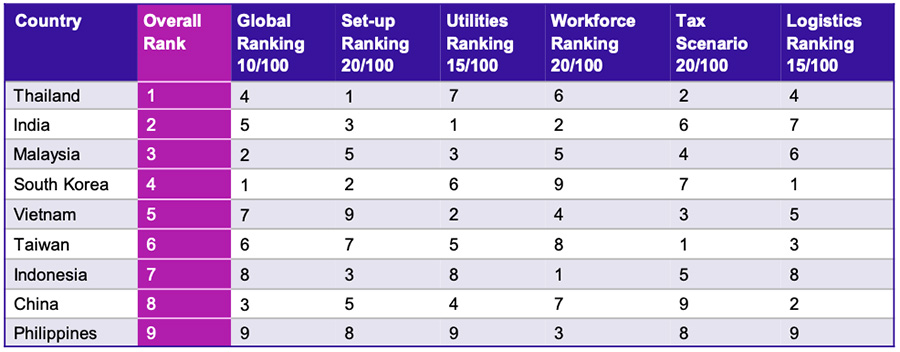

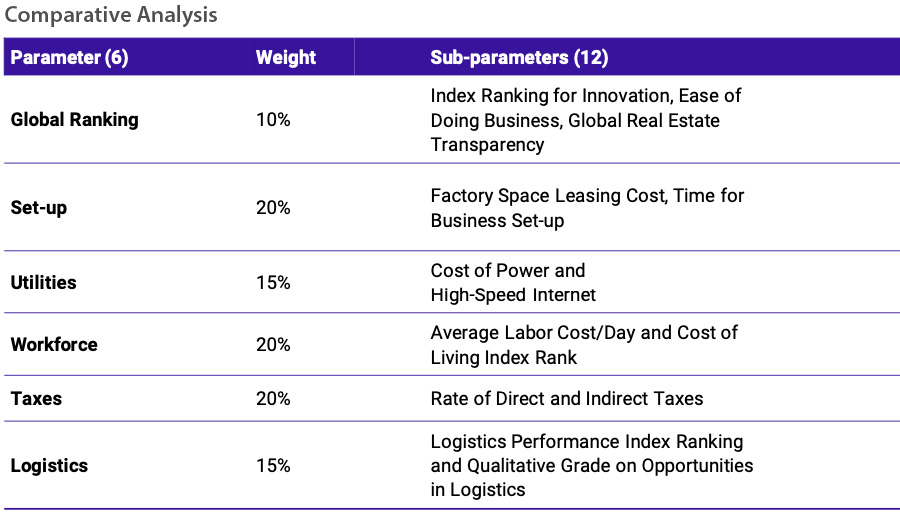

Nexdigm’s analysis, which compared six key determinants of attractiveness, indeed indicates a shifting trend in the manufacturing landscape, concluding that Thailand, India, and Malaysia are currently best positioned to attract investments, with South Korea not far behind.

Across dimensions such as ease of doing business, business setup, utilities, workforce, and tax rates, these countries offer a more favourable business environment compared to China. Meanwhile, the researchers highlight that the leaders are putting notable efforts in continuously refining their policies in order to create a supportive business environment, and promote international investment.

South Korea ranks first in the categories of ease of doing business, innovation, and real estate, followed closely by Malaysia and China. However, ‘rivals’ such as India and Thailand have made significant strides in improving their overall competitiveness by simplifying business regulations, enhancing construction permits, and improving their insolvency frameworks.

In terms of setting up a business, Thailand, South Korea, and China lead the way, offering quick business set-up times of fewer than 10 days. The dimension power/energy shows more even results across the nine countries analysed, with the cost comparable across the countries, except for the Philippines, where costs are substantially higher, and Malaysia, where costs are the lowest.

All selected countries offer improving standards of labour quality and education systems, with South Korea having higher labour costs compared to other countries, and India and Vietnam offering a lower cost of labour.

Overall, Thailand, India, and Malaysia rank highest on Nexdigm’s comparative analysis due to their balanced performance across all six areas of comparison.

“These countries are constantly working on improving their regulatory regime, reducing the number of days required to establish a business, easing registrations/approval requirements, consolidating, and unifying laws, and making compliances easier, business friendly, and more importantly, digital and transparent,” stated Nexdigm.

“With the pandemic causing disruptions in global supply chains, with China at the epicentre, relocating or diversifying the manufacturing footprint has become a crucial [but also challenging] strategy for businesses. Our benchmark serves as a useful insight for businesses looking to diversify their manufacturing footprint in the post-pandemic world.”

Source : Consultancy.asia